Backblaze, Inc. announced its financial results for the fourth quarter and full year ending December 31, 2024.

Fourth Quarter 2024 Financial Highlights

CEO Gleb Budman stated, “Record Q4 sales bookings capped a strong year, validating early traction in our Go-To-Market transformation. We have not only increased sales productivity but also gained an over $1 million ACV customer during the quarter. Additionally, our AI business has started to make a significant impact, with three AI companies among our top ten customers in December 2024.”

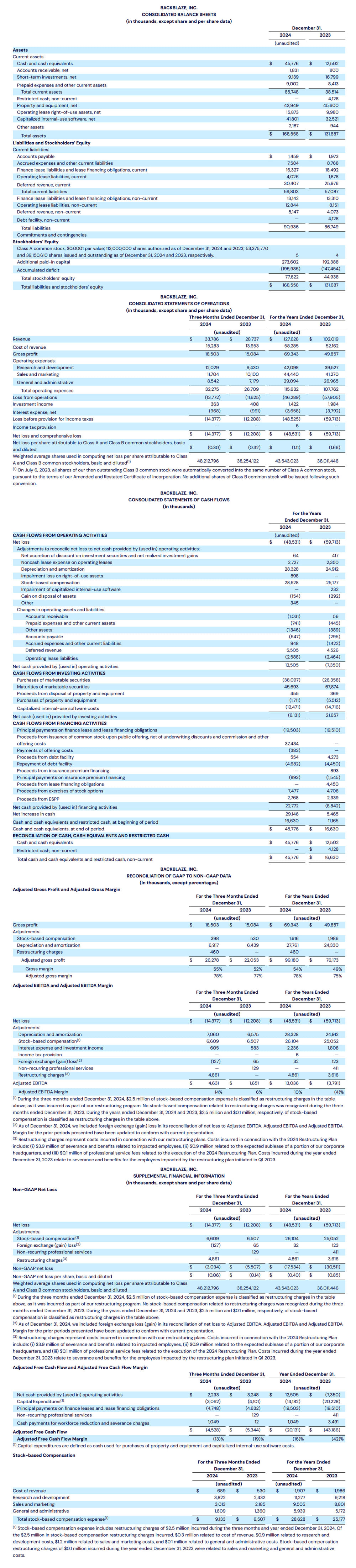

- Revenue reached $33.8 million, representing an 18% increase year-over-year (Y/Y).

- B2 Cloud Storage revenue increased to $17.1 million, up 22% Y/Y.

- Computer Backup revenue was $16.7 million, rising 13% Y/Y.

- Gross profit was $18.5 million, or 55% of revenue, compared to $15.1 million, or 52% of revenue, in Q4 2023.

- Adjusted gross profit increased to $26.3 million, or 78% of revenue, up from $22.1 million, or 77% of revenue in the previous year.

- The net loss stood at $14.4 million, compared to a loss of $12.2 million in Q4 2023.

- Net loss per share was $0.30 versus $0.32 in Q4 2023.

- Adjusted EBITDA reached $4.6 million, or 14% of revenue, improving from $1.7 million, or 6% of revenue, in Q4 2023.

- The non-GAAP net loss was $3.0 million, compared to a loss of $5.5 million in 2023.

- Non-GAAP net loss per share was $0.06, improved from $0.14 in 2023.

- Cash and short-term investments totaled $54.9 million as of December 31, 2024.

Full-Year 2024 Financial Highlights

- Total revenue was $127.6 million, reflecting a 25% increase Y/Y.

- B2 Cloud Storage revenue reached $63.3 million, up 36% Y/Y.

- Computer Backup revenue was $64.3 million, increasing 16% Y/Y.

- Gross profit amounted to $69.3 million, or 54% of revenue, up from $49.9 million, or 49% of revenue in 2023.

- Adjusted gross profit was $99.2 million, or 78% of revenue, compared to $76.2 million, or 75% of revenue in 2023.

- The net loss for the year was $48.5 million, compared to $59.7 million in 2023.

- Net loss per share was $1.11, an improvement over $1.66 in 2023.

- Adjusted EBITDA totaled $13.0 million, equating to 10% of revenue, compared to a loss of $3.8 million, or (4)% of revenue in 2023.

- The non-GAAP net loss was $17.5 million, improved from $30.5 million in 2023.

- Non-GAAP net loss per share was $0.40, compared to $0.85 in 2023.

- Net cash provided by operating activities was $12.5 million, a turnaround from a cash usage of $7.4 million in 2023.

- Adjusted free cash flow was $(20.1) million, improved from $(43.2) million in 2023.

Fourth Quarter 2024 Operational Highlights

- Annual recurring revenue (ARR) was $136.7 million, a 16% increase Y/Y.

- B2 Cloud Storage ARR increased to $70.2 million, up 22% Y/Y.

- Computer Backup ARR rose to $66.5 million, an 11% increase Y/Y.

- The net revenue retention (NRR) rate was 116%, compared to 109% in Q4 2023.

- B2 Cloud Storage NRR improved to 123%, up from 122% in Q4 2023.

- Computer Backup NRR was 109%, compared to 100% in Q4 2023.

- The gross customer retention rate was 90% in Q4 2024, down from 91% in Q4 2023.

- B2 Cloud Storage gross customer retention was 89%, down from 90% in Q4 2023.

- Computer Backup gross customer retention was 90%, consistent with Q4 2023.

- Total customer count reached 507,647, a decline from 511,942 in Q4 2023.

- B2 Cloud Storage customers numbered 107,616, up from 97,842 in Q4 2023.

- Computer Backup customers were 417,845, down from 431,745 in Q4 2023.

- The annual average revenue per customer (ARPU) was $268, up from $228 in Q4 2023.

- B2 Cloud Storage ARPU was $645, an increase from $577 in Q4 2023.

- Computer Backup ARPU rose to $159, compared to $140 in Q4 2023.

Recent Business Highlights

- Backblaze signed a deal for over $1 million in annual contract value with an existing customer, expanding into a Powered by Backblaze white label partnership.

- AI customer growth was significant, with a 65% increase year-over-year, leading to a nearly 10-fold rise in AI-related data.

- B2 Cloud Storage became the primary revenue driver, accounting for over 50% of total company sales.

- A successful secondary offering raised $37 million in net proceeds, bolstering the company’s balance sheet.

- Operational improvements yielded $8 million in annualized cost savings, allowing for reinvestment in sales capacity.

- G2 recognized Backblaze as the ‘Easiest to Use’ and the ‘Fastest Implementation’ object storage solution in their Winter 2025 Report.

Financial Outlook

- For the first quarter of 2025, Backblaze projects revenue between $34.1 million and $34.5 million.

- Adjusted EBITDA margin is expected to fall between 13% and 15%.

- The basic weighted average shares outstanding is anticipated to be between 54.0 million and 54.3 million shares.

For the full year of 2025, the company expects revenue between $144.0 million and $146.0 million, alongside an adjusted EBITDA margin of 16% to 18%.

Backblaze held a conference on February 25, 2025, and an archive of the webcast will be available in the Investor Relations section of the Backblaze website.

Non-GAAP Financial Measures

Backblaze utilizes several non-GAAP financial measures to assess performance, including adjusted gross profit and margin, adjusted EBITDA, non-GAAP net income (loss), and adjusted free cash flow. These metrics are designed to provide a clearer view of operational results, excluding certain non-recurring items. They are not meant to replace GAAP measures but serve as additional context for company performance.

Key Business Metrics

- Annual Recurring Revenue (ARR): Represents the annualized value of all Backblaze B2 and Computer Backup arrangements.

- Net Revenue Retention Rate (NRR): Measures the recurring revenue from a cohort of customers compared to prior year figures.

- Gross Customer Retention Rate: Reflects customer retention without considering revenue expansion or contraction.

- Number of Customers: Counted as distinct accounts with paid cloud services.

- Annual Average Revenue Per User (Annual ARPU): Annualized revenue value per customer.