The demand for advanced memory technologies is hitting new peaks, fueled largely by the rapid growth of artificial intelligence (AI) applications. Recent findings from TrendForce Corp. highlight that the drive towards AI servers is significantly accelerating the development of High Bandwidth Memory (HBM) technologies. This surge in demand is prompting the three leading memory suppliers—SK Hynix, Samsung, and Micron—to actively evolve their HBM4 product roadmaps.

The Evolution of HBM4 Technology

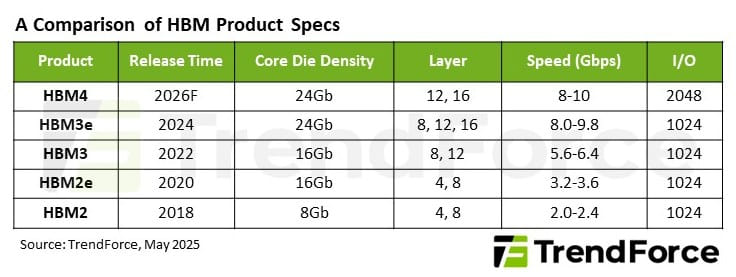

HBM4 represents a substantial advancement over its predecessors, primarily due to its more complex chip design, which results in larger die sizes. One of the standout features of HBM4 is its notable increase in input/output (I/O) count, which doubles from 1,024 to 2,048 compared to previous generations. Despite this increased complexity, HBM4 is expected to maintain a data transfer rate exceeding 8.0 Gb/s, similar to HBM3e. The data throughput capacity is therefore twice that of earlier versions, while operating at the same speed. This is a vital step for applications demanding high-speed data processing, particularly in AI and machine learning frameworks.

One of the significant changes with HBM4 is the transition towards a logic-based base die architecture by some vendors, in contrast to the memory-only architecture utilized by current HBM3e dies. Logic-based architectures enable closer integration between HBM and System on Chip (SoC) solutions, which significantly reduces latency and enhances data path efficiency. This is crucial for applications that rely on high-speed data transfer, as it can lead to improved performance and stability in demanding computing environments.

Market Dynamics and Future Projections

The market for HBM technology is set to expand significantly in the coming years. With AI applications at the forefront of driving this growth, TrendForce projects that total HBM shipments could exceed 30 billion gigabits by 2026. HBM4 is poised to capture a considerable portion of the market as manufacturers ramp up production capabilities. By the latter half of 2026, HBM4 is anticipated to surpass HBM3e as the predominant memory solution in the industry.

As the competition heats up, SK Hynix is expected to maintain its position as the market leader with over 50% market share in HBM4. In contrast, rivals Samsung and Micron will need to enhance their production yields and capacities to compete effectively in this evolving landscape. The introduction of HBM4 is expected to command a premium in the market, likely exceeding 30% based on the increased manufacturing complexity. This follows the trend set by HBM3e, which debuted with an estimated 20% price premium.

Technological Advancements and Industry Response

Notable advancements in HBM4 technology are being actively pursued by leading companies in the chip manufacturing sector. For instance, NVIDIA recently launched its next-generation Rubin GPU at the GPU Technology Conference (GTC) 2023, which is expected to feature HBM4 technology. Similarly, AMD is gearing up for its MI400 series as a direct competitor in the market, also set to utilize HBM4. This competitive landscape is particularly significant as it shapes the future of high-performance computing and AI applications.

The collaboration between SK Hynix and Samsung to adopt a logic-based architecture exemplifies a pivotal shift in the industry. This transition is crucial, as it not only offers lower latency but also supports more efficient high-speed data transmission, which is essential for modern computing needs.

Quick Reference Table

| Specification | HBM4 | HBM3e |

|---|---|---|

| I/O Count | 2,048 | 1,024 |

| Data Transfer Rate | 8.0 Gb/s+ | 8.0 Gb/s |

| Market Share Projection (2026) | Over 50% (SK Hynix) | N/A |

| Price Premium | Expected >30% | Estimated 20% |

| Total HBM Shipments (2026) | 30 billion gigabits | N/A |

As the market for AI and high-performance computing continues to grow, the demand for advanced memory solutions like HBM4 will undoubtedly play a critical role in shaping the technological landscape. Stakeholders in the semiconductor industry will need to navigate the complexities of production and innovation to meet the evolving needs of this dynamic market.