Hewlett Packard Enterprise Development LP (HPE) has released its financial results for the second quarter of fiscal year 2025, ending April 30. The company’s performance highlighted strong revenue growth across its major segments, showcasing its resilience in a changing economic landscape. With increased profitability and operational discipline, HPE aims to continue its momentum in the technology sector.

Financial Performance Overview

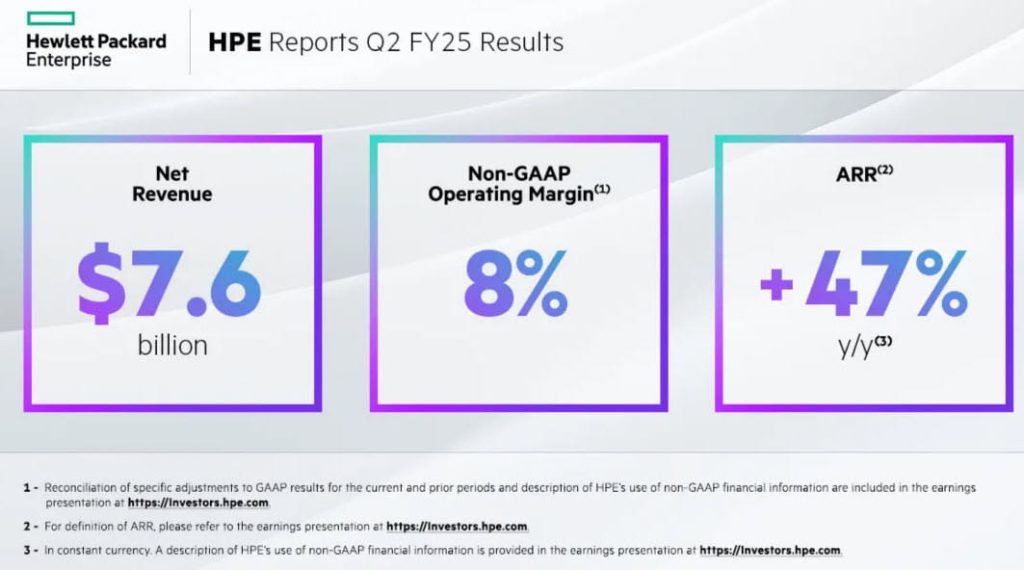

In the second quarter, HPE reported total revenue of $7.6 billion, marking a 6% increase year-over-year in nominal terms and 7% when adjusted for constant currency fluctuations. The annualized revenue run-rate (ARR) grew significantly, reaching $2.2 billion, which reflects a 46% surge compared to the previous year’s figures in actual dollars and a 47% increase in constant currency. This growth indicates a robust demand for HPE’s services and products, as articulated by CEO Antonio Neri: “We delivered a solid performance, achieving yet another quarter of Y/Y revenue growth with strength in each of our product segments.”

Segment Analysis and Margins

HPE’s revenue segments experienced varying degrees of growth, with significant contributions from its core business areas:

- Server Revenue: $4.1 billion, up 6% from the prior year. However, the operating profit margin dropped to 5.9%, down from 11.0% in the previous year, reflecting increased competition and cost pressures.

- Intelligent Edge Revenue: $1.2 billion, up 7% year-over-year, with a profit margin of 23.6%, indicating solid operational efficiency.

- Hybrid Cloud Revenue: This segment saw a remarkable 13% growth to $1.5 billion, with operating margins improving to 5.4% compared to just 1.0% the previous year.

- Financial Services Revenue: $856 million, slightly down at 1.3% year-over-year, yet showing resilience with a profit margin of 10.4%.

Despite these gains, the overall gross margins showed some decline; GAAP gross margin fell to 28.4%, a decrease of 460 basis points from the same quarter last year. Non-GAAP gross margins came in at 29.4%, down 370 basis points year-over-year. Financial analysts will be watching closely to see how HPE manages these margin pressures moving forward.

Impact on Earnings and Cash Flow

HPE’s diluted net earnings per share (EPS) reflected mixed results: GAAP EPS dropped to $(0.82), greatly impacted by a non-cash impairment of legacy goodwill, which alone accounted for $(1.03) of the diluted EPS. Conversely, the non-GAAP EPS was reported at $0.38, which, while down by 10%, still exceeded analysts’ expectations of $0.28 to $0.34.

Cash flow from operations reported a significant decline, landing at $(461) million, a staggering decrease of $1,554 million compared to the prior year’s period. Free cash flow also decreased substantially, totaling $(847) million, down by $1,457 million year-over-year. This decline in cash flow could raise concerns regarding the company’s liquidity, prompting a closer look at operational efficiencies and capital management strategies.

Future Outlook and Strategic Focus

Looking forward, HPE maintains a positive outlook for the third quarter of fiscal 2025, expecting revenue to range between $8.2 billion and $8.5 billion. The company estimates GAAP diluted net EPS to fall between $0.24 and $0.29, while non-GAAP diluted net EPS is projected between $0.40 to $0.45. HPE has provided guidance on potential adjustments made in the non-GAAP EPS estimates, particularly regarding stock-based compensation expenses and amortization of intangible assets.

For fiscal 2025, HPE projects revenue growth of 7% to 9% in constant currency. However, it also anticipates challenges ahead with GAAP operating profit expected to decline by between 72% and 81%. These projections suggest a need for HPE to navigate both market complexities and internal challenges as it seeks to sharpen its competitive edge.

Dividend Announcements and Shareholder Returns

The HPE Board of Directors declared a quarterly dividend of $0.13 per share, payable around July 17, 2025, to shareholders of record as of June 18, 2025. This dividend announcement indicates HPE’s commitment to returning value to its shareholders, even amidst fluctuating financial results.

Market Reaction

The financial outcomes have elicited varied reactions among investors and industry analysts. While the year-over-year revenue growth across several segments reflects HPE’s capability to adapt and innovate, the declining cash flow and margins may invoke skepticism about long-term sustainability. As noted by Brian McCarthy, an analyst at Credit Suisse, “HPE’s ability to manage operational efficiency in a competitive landscape will be critical for maintaining investor confidence moving forward.”

With a strong leadership commitment to innovation and operational excellence, HPE aims to leverage its comprehensive portfolio to drive future growth and enhance shareholder value in the evolving technology landscape.

Quick Reference Table

| Metric | Q2 FY25 Results |

|---|---|

| Revenue | $7.6 billion |

| Annualized Revenue Run-Rate (ARR) | $2.2 billion |

| GAAP Gross Margin | 28.4% |

| Non-GAAP EPS | $0.38 |

| Free Cash Flow | $(847) million |

| Declared Dividend | $0.13/share |