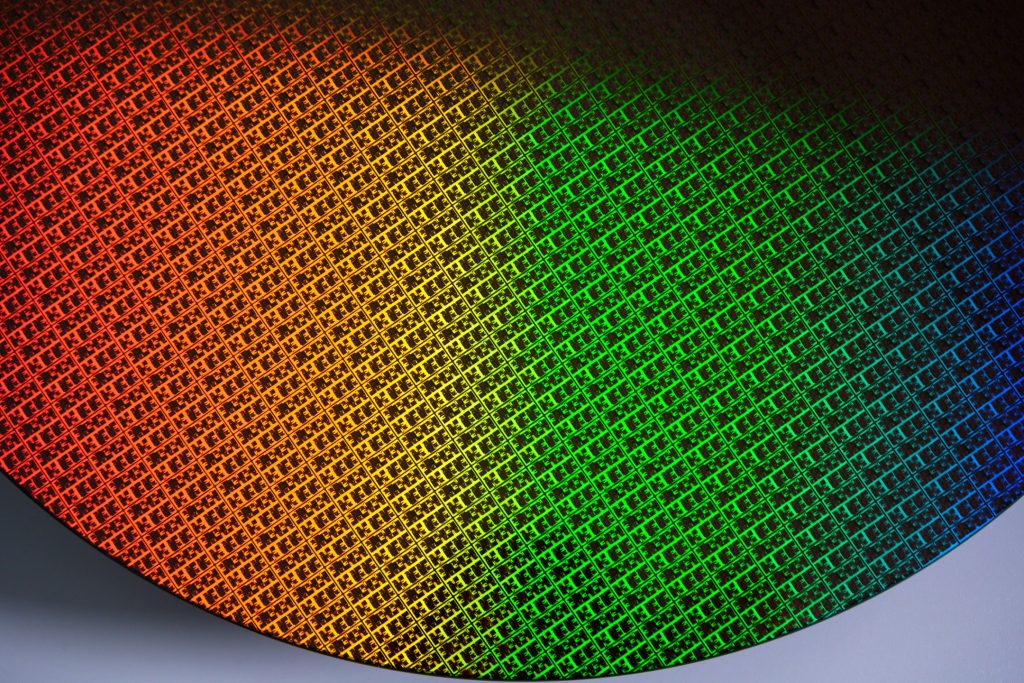

Recent developments from Intel have sparked excitement in the tech community, as the company has made substantial progress with its 18A fabrication process. Reports indicate that the yield rates for this cutting-edge technology are surpassing those of key competitors, offering a glimmer of hope for Intel’s future in advanced semiconductor manufacturing.

Intel’s 18A Yield Progress and Industry Comparisons

As of now, Intel’s 18A process has reached yield rates estimated at 55%. This marks an improvement from the previous quarter’s 50%, demonstrating a steady upward trend essential for Intel’s internal product lines. Research from KeyBanc Capital Markets suggests that Intel’s 18A yields currently outpace Samsung’s 2nm (SF2) process, which is believed to be around 40%. However, it still trails behind TSMC’s N2 technology, reported to have yields at approximately 65%. This competitive landscape highlights the challenges Intel faces in reclaiming its historical dominance in semiconductor manufacturing.

“We continue to hear constructive feedback on Intel’s 18A process and hear that current yield rates have improved to 55%, up from 50% a quarter ago. This compares favorably to Samsung’s 2nm process (SF2), which we believe is tracking at ~40%, but is below TSMC’s N2 process, where yields are currently at 65%.”

The significance of improving yield rates cannot be understated, especially as Intel focuses on the Panther Lake architecture, intended for next-generation mobile CPUs. Intel is expected to ramp up production, with yield rates projected to reach 70% by Q4 2025. Achieving such rates would be crucial not only for internal uses but also for regaining the confidence of external customers looking to adopt Intel’s technology.

Future Outlook: Panther Lake and Beyond

Intel’s future hinges significantly on the success of its Panther Lake architecture, designed to benefit from the 18A node. Reports have suggested that despite uncertainties surrounding the complete commercialization of the 18A process, its achievement in internal products could set a strong foundation for future endeavors in the competitive semiconductor market. While Intel doesn’t aim to outpace TSMC immediately, securing a reliable and effective fabrication process is critical.

The company’s roadmap indicates a strategic transition towards external clientele with the introduction of a subsequent 14A process. This shift aims to bolster Intel’s reputation in the market by delivering reliable, high-performance chips that could vie against TSMC’s offerings, particularly in the realm of custom silicon solutions. The company’s ability to produce competitive volumes and maintain product quality will determine its success in this high-stakes industry.

As Intel progresses with Panther Lake and evaluates its 18A technology, the market will be keenly watching how these advancements translate into performance metrics that can attract both manufacturers and consumers. With the industry’s rapid evolution, maintaining agility in the face of competition is paramount for any semiconductor company, especially one with Intel’s legacy. Deliberate execution in this phase could reshape the competitive landscape and potentially allow Intel to reclaim its status as a leader in semiconductor innovation.

Market Reaction

The semiconductor market is notoriously volatile, often reacting sharply to any indication of product efficacy or yield performance. Intel’s recent yield improvements have generally been met with cautious optimism from investors and industry analysts. For instance, semiconductor stocks often experience fluctuations based on quarterly reports regarding yield rates; Intel’s recent developments may boost its stock performance moving forward.

Furthermore, the competitive benchmarks against rival firms like TSMC and Samsung indicate that while Intel is not yet at the forefront, its trajectory suggests a potentially solid comeback. In a recent report by Forbes, analysts highlighted that the global push towards advanced chip technologies could favor Intel if they manage to stabilize their yield rates and enhance their product capabilities.

With a continuous improvement strategy, Intel’s 18A process may not only support their internal products but could lead to future partnerships and contracts with major tech companies, broadening their market footprint and reinstilling confidence among stakeholders. As the competition in semiconductor technology heightens, watching Intel’s next moves will be essential for understanding the industry’s evolving landscape.