Intel Corporation, the tech giant renowned for its microprocessors, is at a critical juncture in its semiconductor manufacturing strategy. The company has indicated that if it cannot secure a major external customer or meet essential development milestones, it may slow down or even cancel its ambitious 14A process technology (1.4nm-class). This admission marks a significant shift in Intel’s approach, potentially ceding ground in the high-stakes race for leadership in cutting-edge semiconductor technology to competitors like TSMC and Samsung.

Intel’s Strategic Shift

During a recent earnings call, Intel elaborated on its focus on developing next-generation process technologies and balancing its production capacity alongside profitability. A key takeaway from the call was the explicit acknowledgment that the development of the Intel 14A process is contingent upon attracting substantial outside investment. The blunt assessment from Intel reflects a strategic pivot towards a more market-driven model, where the viability of new technologies will dictate development priorities.

In a 10Q filing with the SEC, Intel stated, “If we are unable to secure a significant external customer and meet important customer milestones for Intel 14A, we face the prospect that it will not be economical to develop and manufacture Intel 14A and successor leading-edge nodes on a go-forward basis.” This statement underscores the pressing need for Intel to demonstrate the financial justification for its investments in next-generation nodes.

The Economic Implications of Advanced Technology Development

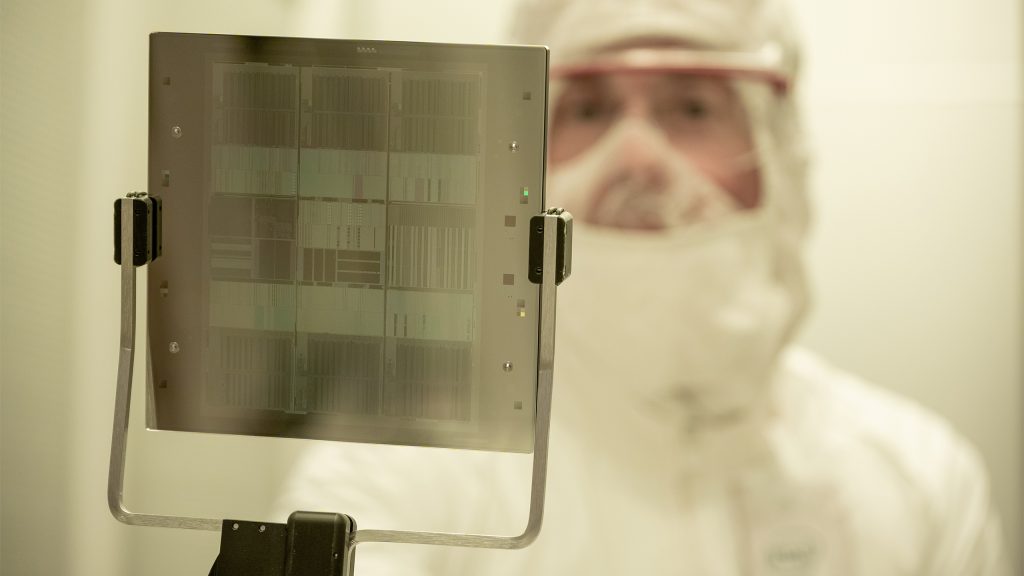

Modern semiconductor fabrication technologies are incredibly costly, with Intel reportedly spending over $16.5 billion on research and development in 2024 alone. This investment covers various projects, including the Intel 18A and 18A-P nodes, but the precise financial requirements for the 14A project remain uncertain. However, it is likely to be a multi-billion dollar venture, mainly because advanced nodes demand expensive lithography equipment and state-of-the-art facilities.

Intel’s ambition for the 14A node includes the use of High-NA EUV (extreme ultraviolet) lithography, which is seen as essential for achieving the desired transistor density and performance. Each ASML Twinscan EXE:5000/5200 High-NA EUV tool comes with a staggering price tag of around $380 million, meaning procuring just two units could necessitate an initial investment of $760 million. Such mammoth expenses necessitate a robust economic foundation for their utilization, not just for Intel’s internal projects but also for external clients.

Market Reactions and Potential Outcomes

Intel’s remarks about possibly abandoning the 14A development route have triggered varied reactions within the semiconductor industry. Industry analysts are closely monitoring Intel’s ability to secure external commitments that could validate its investment in 14A. Some view this situation as a stark warning that Intel may struggle to compete with TSMC and Samsung, both of which have successfully captured a significant market share in the foundry business.

Moreover, if Intel ultimately decides against pursuing 14A and its successors, it plans to continue manufacturing products in-house using nodes up to 18A-P through at least 2030. This approach could prove advantageous for maintaining its existing product lines while managing capital expenditures more effectively. However, a significant concern looms: what might happen to Intel’s profit margins if it increasingly relies on external foundries like TSMC for its most advanced designs?

Industry veteran Lip-Bu Tan, CEO of Intel, emphasized the necessity of securing a reliable commitment from both internal and external customers before proceeding with capital expenditures. He stated, “It’s a lot of responsibility to be serving our customers, make sure that we can deliver the result — consistent, reliable result — to them, so that their revenue can depend on us.” This mirrors the growing trend of semiconductor companies needing to prioritize customer satisfaction and end-user demands to ensure successful product launches.

The Future of Intel in Semiconductor Manufacturing

Intel’s technological roadmap has faced considerable scrutiny in recent years, especially given the competitive landscape dominated by companies like TSMC, which boasts a strong track record in leading-edge process technologies. As Intel navigates its current challenges, it has at least one internal design planned for the 14A node, although there remains a possibility that future designs requiring greater performance may be outsourced to external manufacturers if Intel cannot meet its targets.

The current trajectory suggests that while Intel is poised to keep its existing operations robust through 2030, it must adapt to evolving market dynamics. As the semiconductor industry pivots toward advanced technologies and strategic partnerships, Intel’s ability to innovate and expand its customer base will ultimately determine its relevance in the coming years. Adapting to these challenges successfully may lay the groundwork for Intel’s resurgence in the highly competitive semiconductor market.

For those interested in the latest developments and in-depth analysis on Intel’s shifting strategy and the broader semiconductor landscape, staying informed through credible news sources will be crucial. Tech enthusiasts and industry stakeholders alike are keenly watching as Intel redefines its path forward in the fast-evolving world of semiconductor manufacturing.

Follow Tom’s Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.