The NAND flash market has shown notable signs of recovery as we move toward the latter half of 2025, with substantial improvements in supply-demand dynamics. Recent analyses by TrendForce Corp indicate that production cuts and inventory reductions initiated in the first half of the year have led to a tighter supply chain. As manufacturers continue to shift their production capabilities to focus on higher-margin products, the overall available supply has diminished, signaling a positive trend for pricing and market stability.

Market Dynamics and Price Projections

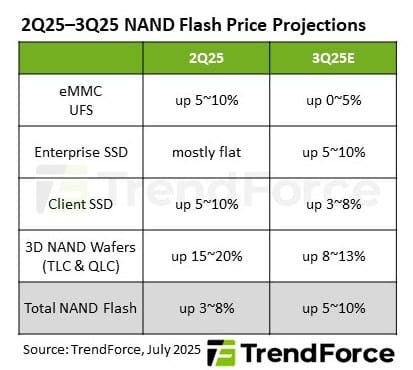

On the demand front, there has been a surge in enterprise investments, particularly in artificial intelligence (AI) technologies, alongside the mass shipments of NVIDIA’s next-generation Blackwell chips. These developments have provided robust support to the NAND flash market, leading to projections that average contract prices for NAND flash will experience an increase of 5% to 10% in the upcoming third quarter. Nevertheless, the forecast for smartphone demand remains ambiguous as we transition into the latter half of the year, which may temper price increases for embedded MultiMediaCard (eMMC) and Universal Flash Storage (UFS) products.

The client solid-state drive (SSD) segment is also poised for recovery with a strong anticipated restocking momentum in the third quarter of 2025. This rebound is attributed to several factors, including the end of support for Windows 10, rising replacement demand driven by the launch of new CPU models, and a growing interest in all-in-one PCs like China’s DeepSeek models. Additionally, suppliers are aggressively marketing high-capacity quad-level cell (QLC) products, further contributing to an uptick in shipment volumes. As a result, contract prices for client SSDs are expected to rise by 3% to 8% in the upcoming quarter.

Supply Chain Challenges and Inventory Issues

Despite these positive indicators, the enterprise SSD market faces significant challenges. The ongoing increase in demand for NVIDIA’s Blackwell platform, combined with expanding needs for general-purpose servers in North America, has resulted in substantial order volumes. However, many supply chain vendors are struggling to fulfill their delivery commitments due to this surge. Previous capacity reductions implemented by suppliers earlier in the year could exacerbate these issues, leading to projected increases in enterprise SSD contract prices of 5% to 10% for Q3 2025.

In the mobile sector, demand for eMMC and UFS products has remained flat. While China’s consumer electronics subsidy policy is still active, the majority of consumer needs have already been met, dampening further demand. Additionally, the previously observed pull-in effect by US tariffs has diminished, resulting in a tepid eMMC demand outlook for the third quarter. This environment has allowed supply levels to stabilize compared to other product segments; however, suppliers have shifted their focus towards higher-end models, raising wafer prices in the process. Consequently, module manufacturers are facing increased costs, impacting their shipment momentum and boosting inventory levels. The result? eMMC contract prices in Q3 2025 are projected to rise by 0% to 5%.

As for the UFS market, uncertainty surrounding smartphone demand and the nascent stages of UFS adoption in the automotive industry have culminated in a notion of a “subdued peak season” for Q3. Supply remains restricted as NAND flash manufacturers prioritize higher profit margins, leading to a forecasted increase in UFS contract prices of 0% to 5% as well.

Insight from TrendForce reveals that in Q2 2025, suppliers’ focus on end-market applications significantly impacted module makers, contributing to elevated wafer inventories. In light of potentially softening demand for consumer-grade NAND flash in the end markets, some module makers are taking a cautious approach toward wafer procurement as they enter Q3. The overall NAND flash output is experiencing a downward trajectory as suppliers redirect their focus toward high-margin products, which, in turn, has led to increased wafer prices projected to rise by 8% to 13% in the third quarter.

Looking Ahead: Market Response and Future Trends

As we gaze into the future of NAND flash and related technology markets, the interplay between supply limitations and rising demand will remain critical in shaping pricing strategies and market dynamics. The industry is witnessing a pivotal shift where innovation, particularly in AI and high-performance computing, could redefine product offerings and consumer expectations.

Moreover, key players in the semiconductor and tech industries are likely to adjust their strategies in response to these evolving market conditions. According to a recent report from SEMI, global semiconductor revenues are anticipated to reach $600 billion by the end of 2025, partly driven by innovations in flash memory technologies. Such growth underscores the significance of NAND flash as a foundational component across various sectors, including consumer electronics, automotive, and enterprise solutions.

In conclusion, the NAND flash market is at a crossroads, with supply chain dynamics, technological advancements, and demand shifts all playing crucial roles in shaping its future trajectory. Stakeholders and consumers alike should remain vigilant in monitoring these trends as they unfold, as they promise to impact pricing, availability, and the overall direction of technology development across numerous fields.