NetApp, a leader in cloud data services, has recently disclosed its financial results for the fourth quarter and fiscal year 2025, marking a period of significant growth and continued innovation. The company has set records across multiple metrics, highlighting its position in the competitive market of data management and storage solutions. This report breaks down the key figures from NetApp’s financial performance and what they mean for the company and its stakeholders.

Financial Results Overview

For the fourth quarter of fiscal year 2025, NetApp reported net revenues of $1.73 billion, representing a year-over-year increase of 4% from $1.67 billion in the same quarter of fiscal year 2024. The growth can largely be attributed to the robust performance of NetApp’s Hybrid Cloud segment, which generated $1.57 billion in revenue. This is an increase from $1.52 billion in the previous year. The Public Cloud segment also saw growth, generating $164 million, up from $152 million in the fourth quarter of fiscal year 2024.

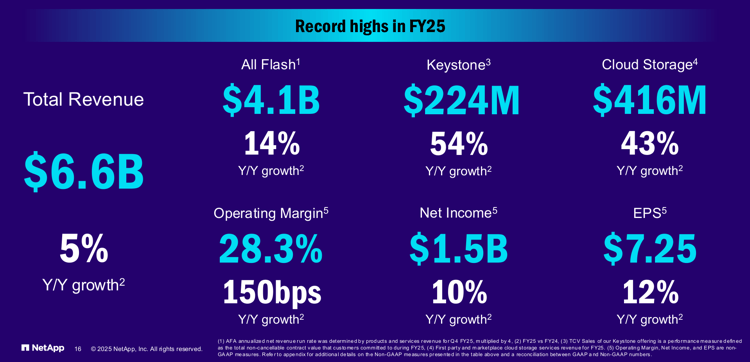

Throughout fiscal year 2025, NetApp achieved record annualized net revenue run rates of $4.1 billion, a 14% increase year-over-year. This is a significant achievement that underscores the company’s expanding market share, particularly in all-flash storage solutions. Additionally, the company recorded total billings of $6.78 billion for the fiscal year, reflecting an 8% increase from the prior year, which solidifies its strong customer demand and strategic partnerships.

Profitability Metrics

NetApp’s profitability metrics are equally impressive. The company reported a GAAP gross profit of $1.19 billion for the fourth quarter and a total of $4.61 billion for the fiscal year, with non-GAAP gross profits of $1.20 billion and $4.67 billion, respectively. The operating profit for the fourth quarter was $348 million (GAAP) and $496 million (non-GAAP), while for the full fiscal year, it reached $1.34 billion (GAAP) and $1.86 billion (non-GAAP). These figures reflect strong operating margins of 20% for GAAP and 28% for non-GAAP over the fiscal year.

In terms of shareholder returns, NetApp has been proactive, returning $1.57 billion to stockholders through share repurchases and cash dividends in fiscal year 2025. This strategic move enhances shareholder value and positions the company favorably in the eyes of investors. The company’s commitment to rewarding shareholders is further emphasized by its next cash dividend of $0.52 per share, which is scheduled to be paid on July 23, 2025.

Strategic Innovations and Partnerships

NetApp’s success can be attributed not only to financial metrics but also to its ongoing innovations and strategic partnerships. During fiscal year 2025, NetApp announced several key product enhancements aimed at bolstering its enterprise storage offerings. Notable developments include updates to the enterprise storage portfolio and the introduction of new security capabilities that focus on enhancing data protection and compliance. These strategic innovations position NetApp as a leader in the rapidly evolving landscape of hybrid and cloud data management.

The company has also formed significant partnerships, including a collaboration with the NFL as its Official Intelligent Data Infrastructure partner. This partnership is geared towards developing innovative storage solutions that drive data management efficiencies within the league. Moreover, collaborations with tech giants such as NVIDIA and Google Cloud have enabled NetApp to enhance its product offerings, particularly in AI and machine learning applications, which are becoming increasingly critical in the data storage industry.

Market Response and Future Outlook

Market analysts have responded positively to NetApp’s financial results, acknowledging the company’s ability to achieve robust growth despite economic challenges. According to a statement from George Kurian, CEO of NetApp, “Fiscal Year 2025 marked many revenue and profitability records, driven by significant market share gains in all-flash storage.” This confidence in future growth is bolstered by the company’s commitment to innovation and strategic positioning to capture emerging opportunities in AI and hybrid cloud environments.

Looking ahead, NetApp has provided guidance for fiscal year 2026, expecting continued growth driven by its enhanced product portfolio and robust market demand. In addition, the company aims to further strengthen its position in the enterprise AI market, which is anticipated to be a game-changer in data processing and management.

Conclusion

NetApp’s financial results for fiscal year 2025 highlight a period of remarkable growth, innovation, and strategic partnerships that set the foundation for future success. With record revenues, profitability, and a clear focus on enhancing customer value, NetApp is well-positioned to lead in the competitive landscape of cloud data services. As the company navigates through fiscal year 2026, stakeholders can remain optimistic about its trajectory in the evolving tech landscape.

For a detailed view of the financial tables and additional information on the financial performance, you can visit the official NetApp financial release page.