Nvidia hosted an impressive event this year in San Jose, attracting a record 25,000 participants to the San Jose Convention Center and nearby venues. The enthusiasm was palpable, with workshops and panels overflowing, causing attendees to lean against walls or sit on floors as organizers struggled to maintain order.

New Business Ventures

During GTC 2025, Nvidia spotlighted its ambitions beyond traditional chip manufacturing, unveiling plans for a new quantum computing center in Boston, the NVAQC. This initiative aims to collaborate with leading hardware and software companies to push quantum computing forward, leveraging Nvidia’s own chips for simulating quantum systems and enhancing quantum error correction.

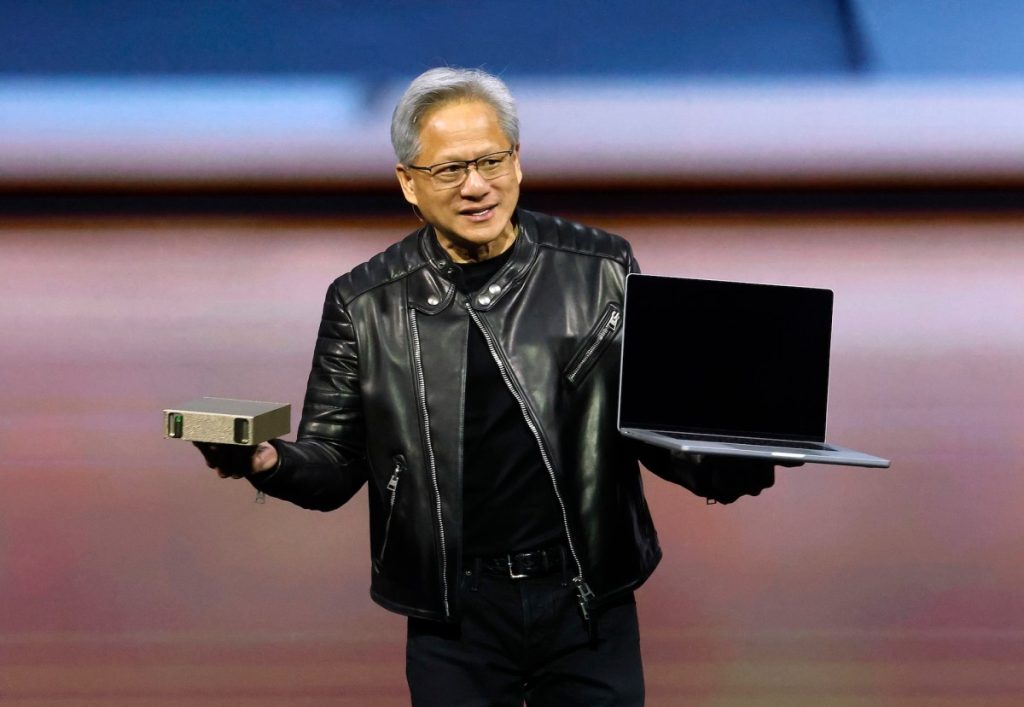

Additionally, the company launched two “personal AI supercomputers,” DGX Spark and DGX Station, marked as the next step in personal computing. These high-end systems are priced in the thousands but are designed for users to prototype and run AI models efficiently. CEO Jensen Huang declared, “This is the computer of the age of AI,” emphasizing their significance in the future of computing.

Inference Demand and Market Challenges

Nvidia’s keynote was focused on reassuring stakeholders about the persistent demand for its chips amid competitive pressures. Huang highlighted that traditional AI scaling is evolving, insisting that the rise of sophisticated models, such as those from the Chinese AI lab DeepSeek, would increase the need for Nvidia’s hardware rather than diminish it. He introduced the new Vera Rubin GPUs, claiming they could perform AI model inference at twice the speed of their predecessors.

Despite this optimism, less attention was given to emerging competitors like Cerebras and Groq, which are developing cost-effective inference solutions. Major cloud providers such as AWS, Google, and Microsoft are also designing their own chips, which could threaten Nvidia’s market dominance as they seek to reduce reliance on Nvidia hardware.

Tariff Concerns and Economic Impact

Amid discussions of growth and innovation, Nvidia addressed potential tariff impacts at GTC. Huang reassured that current U.S. tariffs do not significantly affect their operations, especially since most chips are sourced from Taiwan. However, he acknowledged the uncertainty surrounding long-term economic implications. In response to the “America First” initiative, Nvidia plans to invest heavily in U.S. manufacturing, a substantial financial commitment that could challenge their profit margins.

As investors reacted to Huang’s keynote, Nvidia’s stock price dipped by approximately 4%. Analysts anticipated more groundbreaking announcements or expedited product releases, which did not materialize.

In summary, Nvidia stands firm in its leadership role within the AI sector while navigating challenges from competitors and economic factors. The company’s pivot towards quantum computing and personal AI solutions marks a significant evolution as it seeks to maintain its edge in an increasingly competitive landscape.