Pure Storage, Inc., a leading provider of data storage solutions, has recently announced its financial results for the first quarter of fiscal year 2026, which concluded on May 4, 2025. The company’s performance showcases a robust growth trajectory and reflects its commitment to providing advanced data management technologies.

Financial Performance Overview

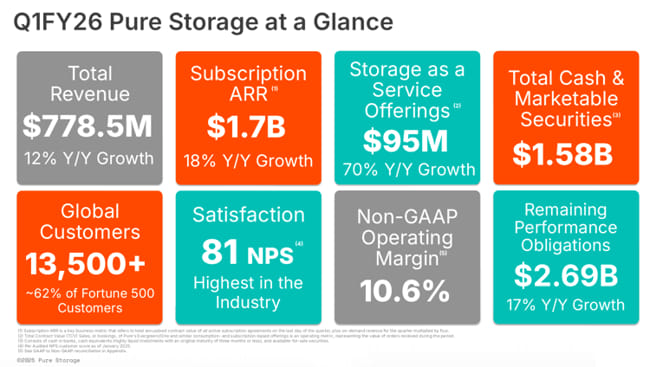

For the first quarter, Pure Storage reported a revenue of $778.5 million, marking a significant 12% increase compared to the same period last year. This growth was driven primarily by a surge in subscription services, which generated $406.3 million in revenue—an impressive 17% year-over-year increase. The subscription annual recurring revenue (ARR) has now reached $1.7 billion, further solidifying the steady growth of the company in this sector, with an 18% year-on-year increase.

Other notable financial metrics included:

- Remaining performance obligations (RPO) stood at $2.7 billion, an increase of 17% year-over-year.

- GAAP gross margin was reported at 68.9%, while the non-GAAP gross margin reached 70.9%.

- Although there was a GAAP operating loss of $31.2 million, the non-GAAP operating income was a positive $82.7 million with a non-GAAP operating margin of 10.6%.

- Operating cash flow was reported at $283.9 million, with free cash flow amounting to $211.6 million.

- The company returned approximately $120 million to shareholders through the repurchase of 2.5 million shares.

“Q1 FY26 was a solid start to the year, with strong revenue growth,” stated Kevan Krysler, CFO of Pure Storage. His insights reflect the company’s strategic focus on adapting to evolving market conditions while fostering growth.

Strategic Developments and Product Innovations

Pure Storage has made considerable advancements in its product offerings, aiming to meet the increasing demands of artificial intelligence (AI) and high-performance computing (HPC) applications. The launch of the FlashBlade//EXA platform is designed to provide unparalleled performance, scalability, and efficient metadata management tailored to these rigorous environments.

Another significant launch was the Portworx Enterprise 3.3 platform, aimed at enhancing data management for virtual machine workloads. These innovations underscore Pure Storage’s commitment to delivering cutting-edge solutions to its clientele.

Market Reactions and Future Guidance

The market seems to respond positively to Pure Storage’s consistent growth, particularly its ability to integrate innovative technologies that cater to high-demand sectors. The upcoming quarters are expected to perform robustly, with guided revenue for the second quarter projected at $845 million, reflecting a year-over-year growth rate of 10.6%. The full-year guidance anticipates revenues of $3.515 billion, suggesting an 11% growth compared to FY25.

As part of the company’s ongoing partnerships, Pure recently announced an integration with the NVIDIA AI Data Platform. This move not only enhances the capabilities of the FlashBlade line but also positions Pure at the forefront of the enterprise storage industry, leading to certifications as a performing storage platform for NVIDIA Partner Network Cloud Partners. Such collaborations are crucial in ensuring that Pure Storage remains competitive in an ever-evolving technology landscape.

Leadership Changes

In a notable leadership update, Kevan Krysler announced he would be leaving Pure Storage after more than five years of service. His tenure has seen the company grow to over $3 billion in revenue and transition into subscription services that now account for roughly 50% of total revenue. CEO Charles Giancarlo praised Krysler’s contributions, acknowledging his instrumental role in driving the company’s financial expansions.

Conclusion and Performance Metrics

Pure Storage’s first-quarter fiscal results not only demonstrate its financial resilience and growth but also its innovative approach toward addressing the demands of contemporary data management needs. Investors and stakeholders are optimistic about the company’s future, particularly given its strategic developments and focused leadership. Key performance metrics, including subscription ARR, confirmed the company’s solid foundation for continued growth and profitability in the field of data storage and management.

Quick Reference Table

| Metric | Value |

|---|---|

| Q1 FY26 Revenue | $778.5 million |

| Subscription Services Revenue | $406.3 million |

| Subscription ARR | $1.7 billion |

| GAAP Gross Margin | 68.9% |

| Non-GAAP Operating Income | $82.7 million |

| Projected FY26 Revenue | $3.515 billion |

For more in-depth insights and future updates regarding Pure Storage, stakeholders can tune into the company’s upcoming teleconference and follow their Investor Relations page.