The NAND Flash market has recently faced significant challenges, leading to a drastic revenue decline in the first quarter of 2025. Findings from TrendForce Corp. indicate that key suppliers in the industry are grappling with high inventory levels and a lack of demand from end markets, resulting in a 24% quarter-over-quarter (Q/Q) drop in combined revenue. This downturn has raised concerns about the future of NAND Flash pricing and supplier performance.

Market Dynamics and Revenue Impact

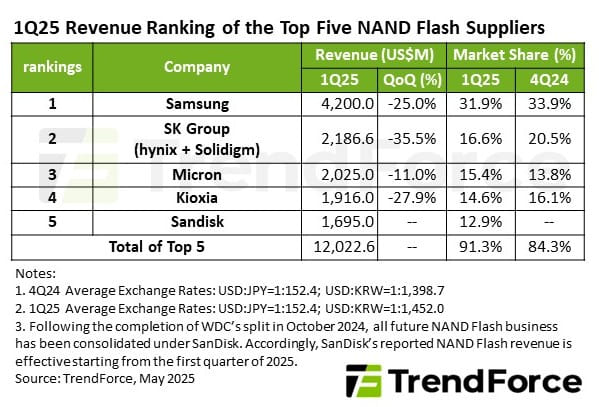

During the first quarter of 2025, the overall average selling price (ASP) for NAND Flash products witnessed a 15% decline, while shipment volumes saw a reduction of approximately 7%. Despite some recovery in product prices toward the end of the quarter, the combined revenue for the top five NAND Flash suppliers fell to $12.02 billion. This significant slump has been attributed to various factors, including seasonal slowdowns and inventory pressures exacerbated by lower enterprise demand.

Looking forward to the second quarter, expectations are slightly more optimistic. TrendForce anticipates that brand revenues could increase by around 10% Q/Q, driven by a gradual recovery in demand as buyers work to balance their inventories. Additionally, U.S. tariffs on certain technology imports are influencing procurement strategies, leading to an acceleration in purchasing behaviors among clients. As the market stabilizes, this could pave the way for a rebound in NAND Flash prices.

Supplier Performance Overview

A closer look at the performance of major suppliers during this challenging period reveals noteworthy trends:

- Samsung Electronics: As the leading supplier of NAND Flash, Samsung reported a substantial revenue drop of 25%, totaling $4.2 billion due to a decrease in enterprise solid-state drive (SSD) demand. However, a rise in NAND Flash wafer prices in March has improved profitability, and upcoming shipments of NVIDIA’s new products are likely to support a recovery in revenue.

- SK Group: Ranking second in the market, which includes subsidiaries like SK hynix and Solidigm, SK Group faced difficulties clearing out inventories of 30TB SSDs. This challenge contributed to a decline in ASP and shipment bits, leading to a revenue drop to $2.19 billion.

- Micron Technology, Inc: Micron saw an 11% Q/Q decrease in revenue, ultimately reaching $2.03 billion. Despite lower ASP, the company benefited from increased shipment bits, allowing it to secure the third position in revenue rankings for the first time.

- Kioxia Corporation: Falling to fourth place, Kioxia reported a revenue of $1.92 billion. This decline can be attributed to weak seasonal demand impacting both shipment bits and ASP.

- SanDisk Corp: Following a split from Western Digital Corp (WDC), SanDisk experienced slight decreases in both shipment bits and ASP, resulting in Q1 revenue of $1.7 billion. The company has announced plans to ramp up shipments of QLC (Quad-Level Cell) products to enhance profitability moving forward.

Future Outlook and Market Trends

The NAND Flash market is currently at a pivotal point, with suppliers reevaluating their strategies in the face of fluctuating demand and pricing pressures. The transition to advanced products like QLC may play a significant role in shaping profitability for companies like SanDisk. Meanwhile, the expected recovery in revenue for Q2 highlights a possible turnaround as suppliers adjust to market conditions.

As manufacturers respond to these challenges, innovations in technology and supply chain adjustments will be vital for maintaining competitiveness. The uncertainties surrounding global trade policies, especially U.S. tariffs, will continue to impact procurement strategies and market dynamics. Industry analysts are closely monitoring how these trends will unfold as 2025 progresses and whether the anticipated recovery can be sustained long-term.

Quick Reference Table

| Supplier | Q1 Revenue (in billion $) | Q/Q Revenue Change | Key Notes |

|---|---|---|---|

| Samsung Electronics | 4.2 | -25% | Enterprise SSD demand sluggish; improved profitability from wafer price rebound. |

| SK Group | 2.19 | -30%+ | Struggling with large-capacity 30TB SSD inventories. |

| Micron Technology | 2.03 | -11% | Increased shipment bits; third in revenue rankings. |

| Kioxia Corporation | 1.92 | -20%+ | Weak seasonality impacting performance. |

| SanDisk Corp. | 1.7 | -10%+ | Planning to increase QLC product shipments. |