At the recent AI Semiconductor Forum in Seoul, South Korea, Samsung announced its intention to implement hybrid bonding technology in its upcoming HBM4 memory. This strategy aims to improve thermal performance and support a wider memory interface. In contrast, rival SK hynix is reportedly postponing its adoption of similar technology.

Understanding HBM Technology

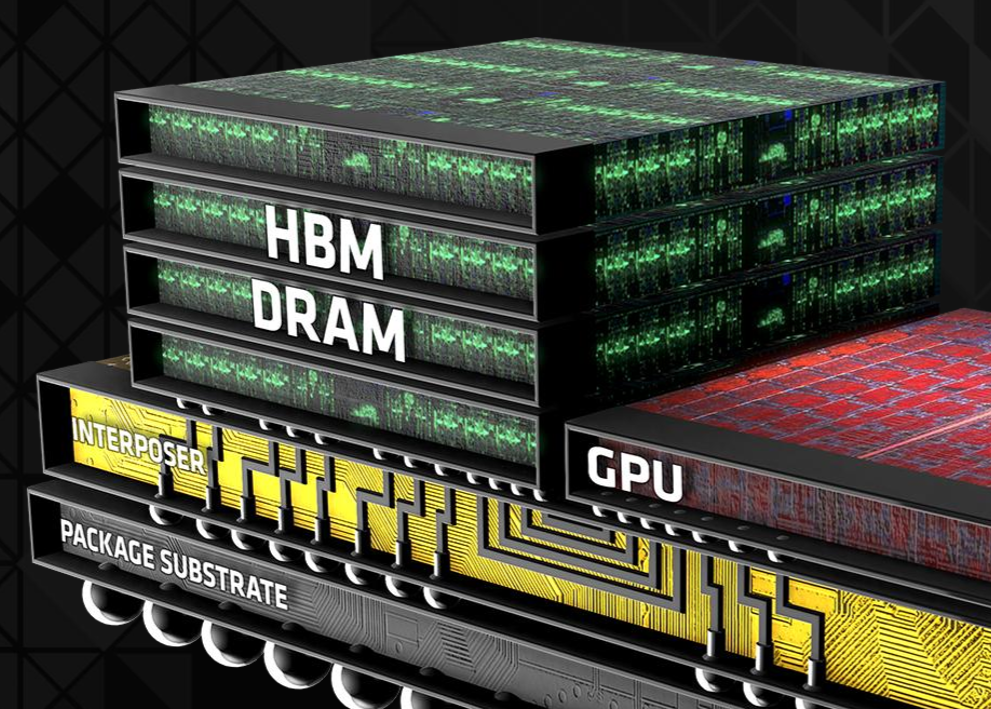

High-bandwidth memory (HBM) involves stacking multiple memory dies on a base die, traditionally interconnected using microbumps. These microbumps facilitate the transfer of data, power, and control signals. Current bonding methods include mass reflow with molded underfill (MR-MUF) and thermal compression with a non-conductive film (TC-NCF). Through-silicon vias (TSVs) are utilized for vertical connections within the stacked dies, transferring essential signals, including data and power.

Advantages of Hybrid Bonding

Hybrid bonding presents an advantage by allowing direct connections between dies through copper-to-copper and oxide-to-oxide bonding, eliminating the need for microbumps. This method supports interconnect pitches below 10 µm, resulting in reduced resistance and capacitance, improved density, and superior thermal management when compared to traditional stacking techniques.

Challenges and Considerations

Despite its benefits, hybrid bonding is considerably more costly than conventional methods. Leading HBM manufacturers, including Samsung and Micron, opted for TC-NCF for their 12-Hi HBM3E, while SK hynix continued with MR-MUF. Samsung is determined to utilize hybrid bonding for HBM4, while SK hynix is developing an improved MR-MUF method, with hybrid bonding as a potential backup.

One significant factor influencing SK hynix’s hesitance towards hybrid bonding is the substantial investment in specialized equipment and the increased space requirements in fabrication facilities. This consideration is crucial for manufacturers operating with limited floor space, leading SK hynix to evaluate the performance of its advanced MR-MUF technique thoroughly before committing to a transition.

Future Implications for the HBM Market

SK hynix’s advanced MR-MUF technology allows for thinner HBM memory stacks, ensuring compliance with JEDEC’s HBM4 specifications. This compliance permits a maximum package height of 775 µm for 16-Hi HBM4 stacks, a reduction from the approximately 800 µm maximum height for 16-Hi HBM3E. If SK hynix can achieve these specifications with existing technologies, it may find hybrid bonding less appealing.

Samsung benefits from having an in-house fab tool manufacturer, Semes, which could potentially reduce its costs. However, the current capability of Semes to produce the advanced tools required for hybrid bonding remains uncertain. Nevertheless, hybrid bonding is expected to become a standard in the future. If Samsung successfully implements this technology for HBM4, it may enhance its competitive stance in the market, potentially reclaiming market share from Micron and SK hynix when mass production begins in 2026.