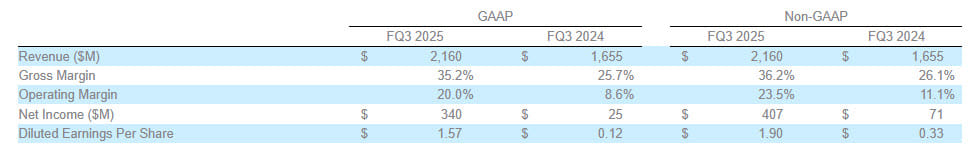

Seagate Technology Holdings plc has released its financial performance for the third quarter of fiscal year 2025, which concluded on March 28, 2025. The company reported substantial revenue of $2.16 billion alongside a GAAP diluted earnings per share (EPS) of $1.57 and a non-GAAP diluted EPS of $1.90. Operational cash flow amounted to $259 million, contributing to a free cash flow of $216 million. Additionally, the Board of Directors declared a cash dividend of $0.72 per share to be paid on July 8, 2025, to shareholders on record by June 25, 2025.

Financial Highlights

- Revenue: $2.16 billion

- GAAP diluted EPS: $1.57; Non-GAAP diluted EPS: $1.90

- Cash flow from operations: $259 million; Free cash flow: $216 million

- Cash dividend: $0.72 per share

CEO Dave Mosley expressed satisfaction with the company’s performance, attributing the successful quarter to structural enhancements in Seagate’s business model and a robust supply-demand balance in mass storage capacity. He emphasized the focus on ramping up HAMR (Heat-Assisted Magnetic Recording) technology to meet cloud customer demands.

Debt Management and Shareholder Returns

During this fiscal quarter, Seagate effectively managed its debt, reducing it by $536 million, resulting in a total outstanding debt of $5.1 billion. The company’s cash and cash equivalents stood at $814 million at quarter-end, with a total of 212 million ordinary shares issued and outstanding.

Future Guidance and Outlook

Looking ahead, Seagate’s guidance for the fiscal fourth quarter of 2025 forecasts revenue between $2.40 billion, with a potential variance of $150 million, and a non-GAAP diluted EPS target of $2.40, also with a variance of $0.20. This guidance considers minimal impacts from existing global tariff policies.

- Projected revenue: $2.40 billion +/- $150 million

- Projected non-GAAP diluted EPS: $2.40 +/- $0.20

Management indicated that the provided guidance excludes certain pre-tax charges related to share-based compensation, and further reconciliation of these figures will be available in subsequent reports.

Cautionary Statements

This financial report contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995, which reflect management’s current expectations regarding future events. Risks and uncertainties could cause actual results to differ significantly, including factors such as market demand, technological advancements, and macroeconomic conditions.

For those interested in further details, supplemental financial information and the comprehensive reconciliation of GAAP to non-GAAP results are accessible through Seagate’s official investor relations site. The management recently conducted a public webcast to discuss the quarterly results, available for listening through their Investor Relations platform.