The foundation of financial decision-making often relies on automated logic that can be rigid and challenging to modify. Adjusting lending criteria, for instance, typically requires a formal request to the IT department. This systemic inefficiency spurred entrepreneurs Maximilian Eber and Maik Taro Wehmeyer, who crossed paths during their studies at Harvard, to address the shortcomings in financial decision automation. In 2020, they established Taktile, a startup focused on streamlining the process of modifying automated decision-making logic.

Taktile’s Vision and Platform

Realizing that they repeatedly built similar solutions while working at QuantCo, an AI-driven enterprise application firm, the duo aimed to leverage their experiences by creating a dedicated platform. “We realized that we were building the same things over and over again and decided to leverage our learnings to build a platform around it,” Wehmeyer, who serves as Taktile’s CEO, shared in an interview.

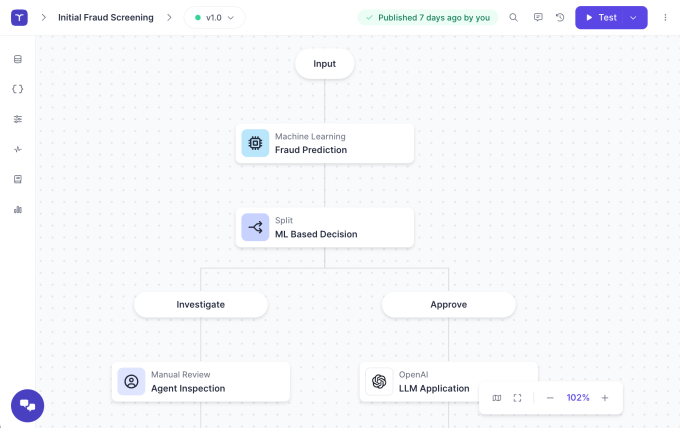

Taktile’s innovative platform enables risk and engineering teams at fintech companies to craft and manage workflows for automated decision-making. Users can integrate various data sources, monitor the efficacy of predictive models within decision-making processes, and conduct A/B testing to assess different approaches. For example, a bank may utilize Taktile to evaluate the impact of lowering the minimum account application age, or a loan provider might create a workflow that efficiently extracts data from documents, summarizes cases, and suggests subsequent actions for manual review.

Wehmeyer emphasized the importance of Taktile’s robust data layer, which enables users to build comprehensive profiles of their customers at all crucial decision points, from onboarding to fraud detection and collections management.

Market Position and Growth

Despite existing competition, such as Noble’s rules-based engine for credit model management and offerings from vendors like PowerCurve aimed at streamlining risk team operations, Taktile has shown impressive growth. The company reported a 3.5x increase in annual recurring revenue for 2024 and has expanded its client portfolio to include notable fintech firms like Zilch and Mercury.

Wehmeyer remarked, “Legacy software is just hopelessly outdated. We’ve won many pitches because even if we were weaker than a specialized vendor in one case, customers want an end-to-end solution.”

Recently, Taktile announced the successful closure of a $54 million Series B funding round, led by Balderton Capital and supported by investors including Index Ventures, Tiger Global, Y Combinator, Prosus Ventures, Visionaries Club, and Larry Summers, a member of the OpenAI board. The total funding raised by the company now stands at $79 million, which will be allocated towards product development and enhancing Taktile’s enterprise sales capabilities.

Wehmeyer stated, “There was no need to raise from a money perspective — we still had more than two years of runway — but we saw huge investor demand because of strong growth in 2024.” He added that in a low-margin sector like fintech, understanding unit economics is critical, and vendor consolidation is a focus area this year.