The enterprise solid-state drive (SSD) market has faced significant challenges in the first quarter of 2025, heavily influenced by persistent inventory issues and production hurdles related to next-generation artificial intelligence (AI) systems. According to recent investigations by TrendForce Corp., these factors have contributed to a notable decline in average selling prices (ASP) and revenues for leading manufacturers in this sector.

Market Challenges and Price Declines

The first quarter saw many major clients reduce their orders leading to a staggering nearly 20% plunge in ASP for enterprise SSDs. This downturn resulted in quarter-on-quarter revenue decreases for the top five vendors in the enterprise SSD market, indicating a period of adjustment and recalibration for many companies. The decline in orders and revenues is significant as it highlights the ongoing challenges these companies face amidst shifting market demands and customer requirements.

Anticipated Recovery in the Second Quarter

Despite the negative trends in the first quarter, the outlook for the second quarter appears more promising. The expected ramp-up in shipments of NVIDIA’s new chips is predicted to drive demand for AI infrastructure, particularly in North America. Furthermore, Chinese cloud service providers (CSPs) are increasing their storage capacities to meet growing data needs, which may further stimulate demand in the enterprise SSD market. Together, these factors could lead to a resurgence in revenue growth across the sector.

Company Performances in Q1 2025

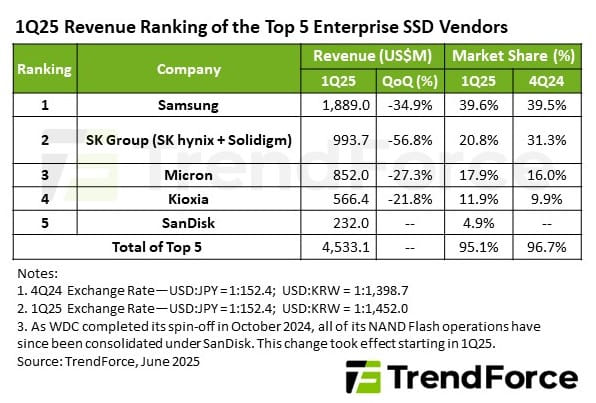

Among the top SSD manufacturers, Samsung Electronics Co., Ltd. retained its position as the market leader but reported a 34.9% drop in revenue to $1.89 billion. This decline was attributed to seasonal effects and diminished demand; however, the company still recorded an increase in shipments of its PCIe 5.0 products, which suggests a potential gain in market share for advanced storage technologies.

SK Group, encompassing SK Hynix and Solidigm, experienced an alarming revenue decrease of over 50%, landing at $993 million. This dramatic drop was largely due to strategic changes by key clients in the AI infrastructure sector. In response, the company is fast-tracking the development of next-generation storage technologies, such as PCIe 5.0 SSDs utilizing Triple-Level Cell (TLC) and Quad-Level Cell (QLC) memory, as part of a comprehensive transformation strategy.

Micron Technology, Inc. reported a Q1 revenue of $852 million. Despite facing market headwinds, it capitalized on the lingering momentum from high-capacity shipments initiated in 2024 and noted a gradual increase in its PCIe 5.0 product line. Its revenue decline of 27.3% was notably less severe compared to others in the industry, showcasing some resilience in its operations.

Kioxia Holdings Corporation recorded a revenue of $566 million in Q1, reflecting a decline of 21.8%. The company attributed this downturn to seasonal softness and less robust orders from server original equipment manufacturers (OEMs).

In contrast, Sandisk Corporation reported an uptick in product shipments, culminating in a revenue of $232 million. Sandisk is strategically focusing on high-capacity storage solutions, recently launching SSD products that offer capacities of up to 1 petabyte (PB). This move emphasizes its leadership in both technological innovation and market understanding.

Future Projections and Market Dynamics

The enterprise SSD market is entering a pivotal phase as it navigates the post-pandemic landscape. Factors influencing market dynamics include the rapid development of AI technologies and the subsequent need for high-performance infrastructure. Companies are expected to adapt to these evolving demands by optimizing their production capabilities and diversifying their product lines.

As previously noted by Statista, the growing reliance on cloud services and big data analytics further supports the upward trajectory anticipated for enterprise SSDs. With the tech industry continuously evolving, the focus will likely shift towards the integration of new technologies that enhance efficiency and performance.

Market Reaction

Analysts express cautious optimism as companies gear up for the second quarter. The ability to address inventory issues and meet renewed demand will be a critical test for the leading SSD manufacturers. As companies innovate and adapt to changing conditions, it will be essential for them to maintain flexibility in production strategies and customer engagement to navigate the fluctuations of this dynamic market.

Quick Reference Table

| Vendor | Q1 Revenue | Q/Q Change |

|---|---|---|

| Samsung Electronics | $1.89 billion | -34.9% |

| SK Group | $993 million | -50%+ |

| Micron Technology | $852 million | -27.3% |

| Kioxia Holdings | $566 million | -21.8% |

| Sandisk Corporation | $232 million | +Growth |