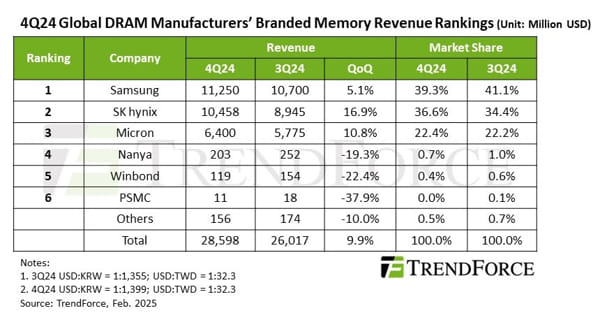

Recent research from TrendForce Corp. indicates that the global DRAM industry achieved revenues exceeding $28 billion in the fourth quarter of 2024, representing a 9.9% increase compared to the previous quarter. This growth was largely fueled by higher contract prices for server DDR5 and a significant volume of High Bandwidth Memory (HBM) shipments, which contributed to revenue growth among the leading three DRAM manufacturers.

Market Dynamics and Future Projections

Despite a general downturn in contract prices across various applications, demand for high-capacity server DDR5 from major American cloud service providers (CSPs) has helped maintain price stability for server DRAM. As the industry transitions into the first quarter of 2025, a historically slow season is anticipated, prompting a reduction in overall bit shipments from DRAM suppliers. PC original equipment manufacturers (OEMs) and smartphone producers are expected to continue inventory clearances, leading suppliers to redirect some DDR4 and HBM production back to server DDR5. Nonetheless, with weakened CSP demand, a decline in contract prices for conventional DRAM and the combined pricing of conventional DRAM and HBM is projected for this quarter.

Leading DRAM Manufacturers

Samsung continues to lead the DRAM market with revenue of $11.25 billion, a 5.1% increase quarterly. However, the company has seen a slight reduction in market share, attributed to decreased bit shipments stemming from diminished demand for LPDDR4 and DDR4, as well as a delayed focus on concentrated HBM shipments until late 2024.

SK Hynix stands in second place, reporting $10.46 billion in revenue for 4Q24, marking a substantial 16.9% quarter-over-quarter growth. This increase in revenue can largely be attributed to a surge in HBM3e shipments, which compensated for declines in LPDDR4 and DDR4 shipments, resulting in a market share rise to 36.6%.

Micron ranks third with revenues reaching $6.4 billion, reflecting a 10.8% quarterly increase. This growth resulted from expanded server DRAM and HBM3e shipments, allowing Micron to maintain a consistent market presence from the previous quarter.

Challenges for Taiwanese DRAM Companies

In contrast, Taiwanese DRAM manufacturers encountered revenue declines in 4Q24, primarily due to weakening consumer demand for DRAM and intensified competition from Chinese suppliers in the DDR4 segment. Nanya Technology reported revenues of $203 million, a decrease of 19.3% from the previous quarter, while Winbond experienced a 22.4% drop in consumer DRAM shipments, generating $119 million in revenue.

Furthermore, PSMC’s DRAM revenue, driven mainly by consumer DRAM production, experienced a significant 37.9% quarter-over-quarter decline, amounting to $11 million, as wafer input volumes decreased. Overall, PSMC’s revenue fell by 10% compared to the previous quarter, even after accounting for foundry service revenue, reflecting stable demand from foundry customers.