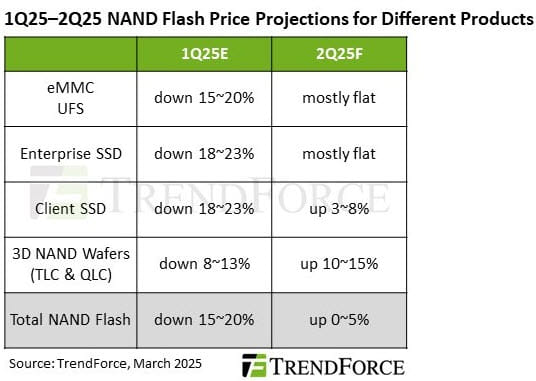

According to TrendForce Corp., NAND flash suppliers have begun scaling back production in late 2024, leading to observable market changes. This adjustment coincides with an uptick in production among consumer electronics brands, driven by potential US tariff increases, which has fueled demand. As inventory levels are replenished across sectors such as PCs, smartphones, and data centers, NAND flash prices are anticipated to stabilize in the second quarter of 2025, with expected increases in prices for wafers and client SSDs.

Client and Enterprise SSD Price Trends

After facing three consecutive quarters of inventory depletion, demand for client SSDs is regaining momentum as original equipment manufacturers (OEMs) ramp up production. The approaching end of Windows 10 support and the release of next-generation CPUs are likely to further boost replacement demand in the PC market. Additionally, technologies like DeepSeek are driving the adoption of edge AI, enhancing the need for client SSDs.

As supply issues are addressed, client SSD contract prices are projected to experience a quarterly increase of 3% to 8% in the second quarter. Meanwhile, enterprise SSD prices are expected to stabilize, thanks in part to earlier procurement by some server clients, even as overall demand from server brands has been below expectations.

Market Dynamics for eMMC and UFS

For eMMC and UFS storage solutions, prices are expected to remain stable due to various factors. A rise in shipments of smart TVs, tablets, and Chromebooks, along with steady demand for mid-to-low-end smartphones in emerging markets, has positively influenced eMMC orders. Despite previous oversupply conditions that led to financial losses for NAND flash manufacturers, production cuts have been implemented to restore market balance. Consequently, eMMC contract prices are projected to remain flat.

UFS demand is supported by high-end smartphones and increasing storage needs in automotive applications. However, overall NAND flash capacity adjustments have reduced the availability of UFS, leading to an expectation that Q2 contract prices will stay consistent with the previous quarter.

NAND Flash Wafer Market Outlook

In the NAND flash wafer sector, prices have bottomed out, and inventory restocking initiatives are in progress. As procurement activities increase from module makers and OEMs, heightened interest in high-end wafers correlating with rebounding enterprise SSD demand is evident. Factors such as reduced wafer supply from production cuts and strategic pricing adjustments are expected to lead to a rise of 10% to 15% in NAND flash wafer contract prices in the second quarter.