In a compelling display of financial growth, Rubrik, Inc. has reported exceptional results for the first quarter of fiscal year 2026, which ended April 30, 2025. CEO Bipul Sinha emphasized that these results not only exceeded all metrics set forth but also underscore the company’s innovative approach and strong execution in the expanding cyber resilience market. The performance metrics present a significant year-over-year increase, reflecting a robust demand for Rubrik’s solutions.

Impressive Financial Metrics

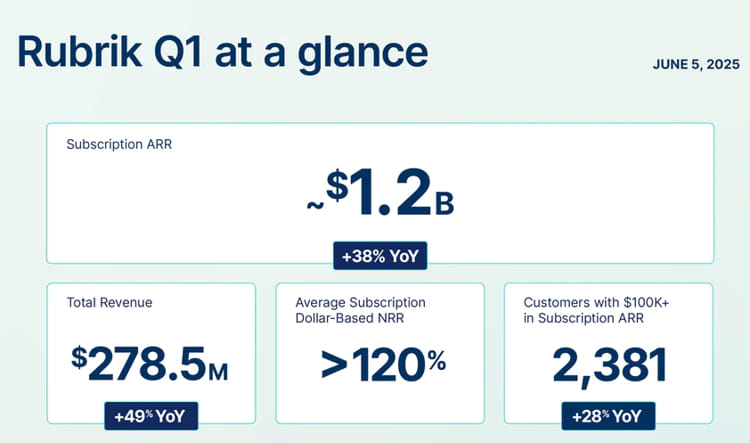

As detailed in their recent financial disclosures, Rubrik achieved a remarkable 38% year-over-year growth in Subscription Annual Recurring Revenue (ARR), bringing the total to $1.18 billion. This surge is indicative of the increasing trust and reliance on Rubrik’s services within enterprises, solidifying their position in a competitive landscape. Additionally, total revenue for the quarter reached $278.5 million, marking a 49% increase from the previous fiscal year with subscription revenue alone at $265.7 million, a testament to their successful growth strategy.

Key Highlights

- Customer Growth: Rubrik noted an increase in the number of customers contributing $100,000 or more in Subscription ARR, with a 28% rise to a total of 2,381 customers.

- Strategic Partnerships: The company has actively pursued collaborations, including a partnership with Google Cloud aimed at enhancing their cloud-based recovery solutions. This includes new features for threat analytics and expanded protection for Google Cloud services.

- Recognition: Rubrik was named the 2025 Google Cloud Partner of the Year for Infrastructure Modernization, further affirming their capabilities in delivering robust data security and recovery solutions.

“Our outstanding first-quarter results not only surpassed all guided metrics but also underscore the power of our focused innovation and execution. We are winning the cyber resilience market, and I believe that our opportunity is bigger than ever,” Sinha said in a statement regarding the quarterly results. CFO Kiran Choudary complemented this sentiment by noting that the quarter represented a strong start to their second fiscal year as a public company, highlighting solid revenue growth and progress towards profitability.

Financial Breakdown

Rubrik’s financial highlights present essential insights into their operational success:

- Gross Margin: The company achieved a GAAP gross margin of 78.3%, a significant increase from 48.8% in the same quarter last year.

- Net Loss Reduction: GAAP net loss per share decreased to $(0.53), a notable improvement from $(11.48) in the previous fiscal year, reflecting a substantial reduction in stock-based compensation expenses.

- Operational Cash Flow: Cash flow from operations was reported at $39.7 million, a stark contrast to the $(31.4) million from the same quarter last year, signaling improved cash management and operational efficiency.

Future Outlook and Expectations

Looking ahead, Rubrik has provided guidance for the second quarter of fiscal year 2026, projecting revenue between $281 million and $283 million. They also expect a non-GAAP Subscription ARR contribution margin ranging from 4.5% to 5.5% and a non-GAAP EPS between $(0.35) and $(0.33). For the full fiscal year 2026, the company estimates a Subscription ARR between $1,380 million and $1,388 million, in addition to a revenue target of $1,179 million to $1,189 million.

A notable move in Rubrik’s management recently included the appointment of Kavitha Mariappan as chief transformation officer, a strategic role aimed at enhancing executive engagement and accelerating cyber resilience initiatives for both global enterprises and public sectors. With an extensive background in enterprise software and cybersecurity, her experience is expected to drive further innovation within the organization.

Market Reaction and Industry Implications

Rubrik’s strong financial results have elicited a positive response from the market, as investors are likely encouraged by the company’s growth trajectory and strategic initiatives. The public’s growing concern over cybersecurity has created an expansive market for firms like Rubrik that focus on data protection and recovery solutions. Given that the cybersecurity sector is projected to exceed $300 billion by 2026, according to a report by Statista, Rubrik’s strategic moves are timely, positioning the company advantageously within this booming landscape. As the need for robust cybersecurity solutions surges, Rubrik’s growth metrics and future outlook indicate a promising trajectory that could attract further investments and partnerships, enhancing their market dominance.

For further updates and detailed financial reports, Rubrik continues to provide access through their investor relations website, where they hosted a conference call on June 5th to discuss their results further.

As Rubrik continues to innovate and expand its presence in the cyber resilience market, stakeholders will undoubtedly keep a close eye on their performance and strategic decisions that will shape the future of data security solutions.

For additional details, you can access the full financial report on Rubrik’s official site and explore their strategic plans at Rubrik’s investor relations website.