TrendForce Corp. has released a report indicating that recent tariff increases in the U.S. have led to many downstream brands preemptively shipping products ahead of schedule for the first quarter of 2025. This has resulted in a swift reduction of inventory across the memory supply chain.

Price Forecast for DRAM in Q2 2025

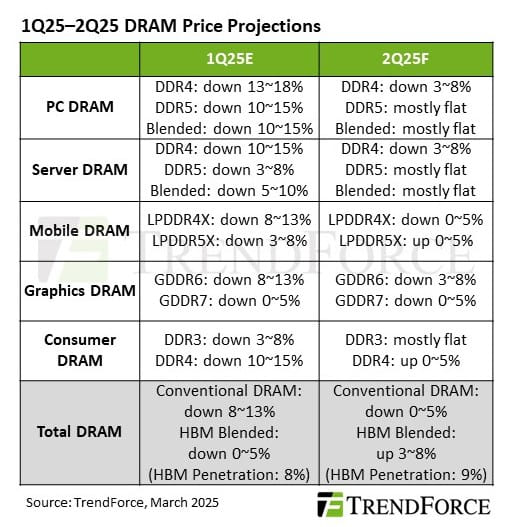

For the upcoming second quarter, conventional DRAM prices are projected to decrease by a modest 0-5% quarter-over-quarter. In contrast, prices for DRAM that includes High Bandwidth Memory (HBM) are expected to increase by 3-8%, fueled by heightened shipments of HBM3e 12hi.

Stability in PC and Server DRAM Markets

In light of potential tariff hikes, key PC Original Equipment Manufacturers (OEMs) are urging their Original Design Manufacturers (ODMs) to ramp up production, which is accelerating the depletion of DRAM stocks. OEMs with lower inventory are likely to increase procurement efforts in Q2 to secure a stable supply of DRAM for the latter part of 2025.

On the supply side, while Samsung’s progress in HBM qualification has fallen behind expectations, the company has maintained its capacity management strategy for conventional DRAM. SK hynix is concentrating on server and mobile DRAM production, restricting the supply of PC DDR5. Given the tepid consumer demand and ongoing capacity expansions from Chinese firms, DDR4 prices are forecasted to remain stable in Q2.

Mobile and Graphics DRAM Trends

Demand for mobile DRAM is experiencing growth, aided by subsidies for smartphones in China and a slight uptick in high-end smartphone sales. Additionally, LPDDR5X bit consumption has risen due to demand from PC and server applications. Although LPDDR4X supply is sufficient, prices are expected to see a modest decline of 0-5%. In contrast, LPDDR5X continues to be in tight supply, prompting suppliers to project a quarter-over-quarter increase of 0-5%.

In the graphics DRAM segment, the anticipated demand for GDDR7 primarily stems from next-generation graphics card inventory preparations. While GDDR7 prices are expected to stabilize or witness a slight decrease due to limited supply, GDDR6 prices might fall by 3-8%, supported by demand from AI developments like DeepSeek’s open-source model. Major DRAM producers are bundling GDDR6 to help stabilize prices and expedite inventory clearance amidst erratic GDDR7 supply.

Consumer DRAM Market Dynamics

The consumer DRAM sector is positioned to benefit from the rollout of new infrastructure, such as 4G/5G base stations and fiber upgrades, which should incrementally lift demand. With healthy inventory levels, there is a trend towards more aggressive purchasing, indicating potential growth in demand quarter-over-quarter.

On the supply front, DRAM manufacturers have adopted a more cautious approach in the latter half of 2024, reducing DDR3 and DDR4 output in response to inventory excess and weak market demand. As a result, DDR4 contract prices are predicted to rise by 0-5% in Q2 2025 due to restricted production and an anticipated rebound in demand. Conversely, DDR3 prices are likely to remain unchanged as lingering overstock continues to impact the market, despite recent procurement efforts.